Beyond pure returns, most Investor Unity clients seek maximum consistency and longevity through careful aversion of all unnecessary risk.

IU’s broader investment approach centres around this type of client.

Nonetheless, terms such as ‘conservative’ and ‘assertive’ are highly subjective. They are not one-size-fits-all concepts.

Therefore, the MSPV service offers a dynamically adjusted risk multiple, which aims to automatically optimise risk multiples to prevailing market conditions on a more assertive basis.

Additionally, clients who are comfortable seeking higher returns with higher risk (in terms of growth swings) can simply apply a performance multiplier to the standard service – at a multiple of their choosing, as illustrated below.

The below performance details track two key risk:performance models, since inception (July 2021) of:

Figures are updated live. Past performance is not an assurance of future returns. Be sure to consider your personal circumstances and consult your adviser as necessary.

MSPV employs the same strategy as MSP; with performance multiplied typically by 1x to 3x, through larger individual trade sizes.

Performance here is based upon MSPV at a 2x multiple; intended for consideration by those comfortable with higher growth swings and higher risk in general.

MSP employs a dynamically adapted approach, as a single-account investment.

MSP aims to steadily outperform traditional funds, with reduced drawdown (by duration and amount), freely withdrawable gains, and near-zero reliance upon a positive, global economic climate.

Note: The above automatically reports the MSP results from a third-party verifier.

Past performance is not a guarantee of future returns, and is presented for general advice purposes only. Individual account results may differ with varying fees etc. IU standard fees for the previous financial year approximately totalled 2.3%. Figures shown above for MSPV-2x are NET of all fees.

Since inception, MSP models have generated returns comparable or greater than the share market, yet with:

Note: ‘Drawdown’ is the term for a decrease in an account/investment value (peak to trough). For example, the Australian share market experienced a near 40% drawdown in 2020.

An expanded video explanation of the above and more can be viewed in the live webinar recording.

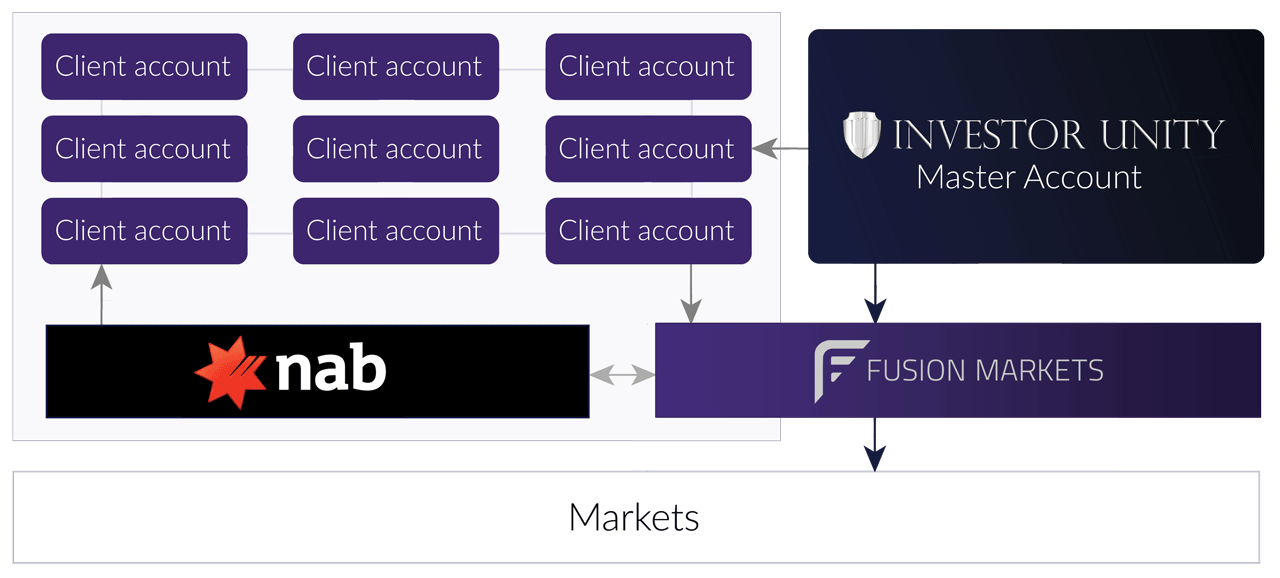

IU’s core service is MSP (Managed Strategy Portfolio). Those seeking a tailorable & reliable investment are able to establish a fully independent brokerage account, separately from IU, with funds secured through National Australia Bank, which then can be synchronised to the managed portfolio.

For more regular updates on performance and more, be sure to join as a Guest Member (instant, free forever).

For more details see the MSP service fact-sheet and more, below.

| Managed Strategy Portfolio – core strategy details (standard settings) | |

|---|---|

| Minimum initial deposit | 5000 AUD |

| Suggested minimum initial deposit | 10000 AUD |

| Setup fee | 0 |

| Monthly fee | 0 |

| Performance fee | 0 |

| Management fee | 0 |

| Largest single loss | 2.20% |

| Largest account decrease (‘drawdown’) | 24.7% (Apr. 2017, former strategy) |

| Brokerage fee on $10k shares trade | $15 (no min. fee) |

| Brokerage fee on $10k non-shares trade | $0.65 (no min. fee) |

| Segregated client trust account | National Australia Bank |

| Funds accessible to | Client only |

| Minimum term commitment | None |

| Withdrawal fee | None |

| Security of deposits | +30 years in business, ASIC-regulated |

| Ongoing transparency | 24/7 account access |

| IU MSP Service | Most Managed Funds | |

|---|---|---|

| Returns highly dependent upon positive global market/economic conditions | No | Yes |

| Can stay completely out of the market, in times of excessive risk/uncertainty | Yes | No |

| Can take advantage of falling markets | Yes | No |

| 24hr live transparency of account activity | Yes | No |

| Direct contact with strategist (investment decision maker) | Yes | No |

| Adjustable risk-tolerance settings available | Yes | No |

| Conditional pause (loss/profit-protection) available | Yes | No |

| Funds stay in liquid form, not units | Yes | No |

| Access to funds controlled by client, not the firm | Yes | No |

| Funds quickly accessible to clients, without restriction nor fees | Yes | No |

IU was officially formed in Sydney in 2012, by its Founder & Strategist Adam La Vars, being licensed in Securities & Derivatives, under ASIC Regulatory Guidelines since 2006.

Our core business is the development and ongoing refinement of strategies for our Managed Strategy Portfolio service (MSP), which intended for consideration by those seeking a tailorable & reliable, long-term investment.

Since inception, our approach has not only weathered all major market turmoil and equities market ‘crashes’, but has provided our clients a far smoother growth curve than typical, off-the-shelf funds.

By industry standards, we consider our approach conservative, and assure clients that they can (at minimum) expect precise risk controls – along with an investment which provides true diversification, having no reliance upon a positive economic environment.

Nonetheless, terms such as ‘conservative’ and ‘aggressive’ are highly subjective; being specific to the individual client.

Therefore, MSP can be employed at tailored performance levels. This allows a client to simply request a higher/lower level, which thereby increases/decreases both their risk and reward potential (without changing the strategy itself).

Custom settings can be adjusted at any stage, with many clients preferring simply to begin at moderate/conservative levels.

A large portion are retirees or those nearing. Most clients prioritise risk-management, security of funds, transparency and access to cash withdrawals.

For the sake of transparency and ongoing updates, live and archived education is provided to all Members, with Guest membership being free and open to all.

Despite any ASIC accreditation, we have no access to client funds. Client funds are deposited directly to a partnering broker.

Clients authorise the connection of their account to the master portfolio, for synchronisation purposes only. This does not provide access to client funds, under any circumstances.

Our primary partners are top-tier brokers only, holding client funds in segregated client trust accounts, under maximum protection of ASIC client money laws.

In most cases, the broker application process is 100% digital, and takes some 15 minutes to complete.

Once established, the client submits a short additional form, authorising us to connect their account. From this point, the client account receives buy/sell orders according to the strategy portfolio.

MSP has no establishment, management, subscription, data or software fees. MSP clients pay for their trades only. Rates can vary, depending upon the broker, but are less than 1.5x the broker’s standard rates.

For the sake of optimal risk-mitigation, the world’s largest and most liquid markets are favoured. This includes US equities, global equity indices, and a large focus upon major global currency markets.

The suggested minimum for the Managed Strategy Portfolio service is $5,000 (AUD/equivalent).

Since its inception, IU has a always had a strong belief in communicating ideas through education. By making full use of today’s technology, our commitment to the utmost possible transparency, and ongoing client-relationship development, can be maximised.

To remind and be clear – IU Membership is free of:

A) Cost

B) Obligation

C) Any kind of SPAM or typical guru nonsense — guaranteed

To learn more about specifics relating to the market, approach, performance concepts, risk management and more:

1) Contact us here – or message us in the lower-right corner

2) Book a time to talk in detail – message in the lower-right corner

3) Join as a Guest Member and/or for the IU Academy (free – here)

Each client account is fully separate, with funds secured through National Australia Bank. No National Australia Bank account required. SMSF compatible.

There currently are two cost-structure models to choose. The client chooses (a single) one of the models, and can switch to a different model at any stage:

Option 1: Pay for your trades only. A mark-up is applied to the broker’s standard costs:

For Shares CFDs: 0.15% of the trade value (no minimum fee)

▸ Example: A trade on Google, to the value of $10,000 AUD, would incur a total brokerage cost of $30 AUD ($15 entry + $15 exit)

For non-Shares CFDs: 13 points, in the underlying currency equivalent (no minimum fee)

▸ Example: A trade on AUDUSD, to the value of $10,000 AUD, would incur a total commission cost of $1.30 AUD ($0.65 entry + $0.65 exit)

This model (Option 1) requires an account with a broker that IU is partnered with.

Option 2: Pay a quarterly subscription only. Pay your broker’s standard costs only.

The subscription cost is based upon the size of your account.

For this option, a subscription will need to be purchased. Please note that this model is slightly more expensive than Option 1, though offers the benefits of capped fees, and wider choice of brokers.

Any compatible broker can be used, as long as they offer a MT4/5, cTrader, or Trading Station platform.

Your account will then be receiving orders, instantly and automatically. You can view account activity (live), statements, add/withdraw funds and more – simply by logging into your online account.

No SPAM, no sales-people, no nonsense – guaranteed.

This website is owned and operated by Investor Unity Pty Ltd (ABN: 90 160 624 331). Any advice included in this website or correspondence is general advice only and is based solely on consideration of the investment or trading merits of the financial products alone, without taking into account the investment objectives, financial situation or particular needs (i.e. financial circumstances) of any particular person. In addition to its internal services, Investor Unity is compensated by brokers and other third parties by way of referral/affiliate and/or general partnership arrangements, via its websites and other communications. Investor Unity is genuinely interested in your long-term trading & investment success. We advise you to take all necessary steps to ensure you have a good understanding of the products & services you’re considering investing in – particularly if they involve leverage. While Investor Unity takes every care to ensure that we only deal with the highest quality services, from throughout the industry, past performance is not a guarantee of future performance. Before making an investment or trading decision based on the general advice, the recipient should carefully consider the appropriateness of the advice in light their financial circumstances and should carefully review the PDS of the relevant financial product as provided by your investment broker. Past results are not a guarantee of future performance. Please contact us, to discuss any questions or concerns you may have- we are here to help.

Hi {{user.first_name|default(‘there’)}}.

Please note that the comparative performance chart/figures, along with other key points on this page, are being updated.

The update should be complete by Monday, in line with the scheduled live session (webinar):

Please get in touch for any specifics, in the meantime.